Tax Department.

A As a sovereign nation and exercising the right to tax, the Shoshone-Bannock Tribes passed the Tribal Tax Code in 1991.

Tax and Revenue .

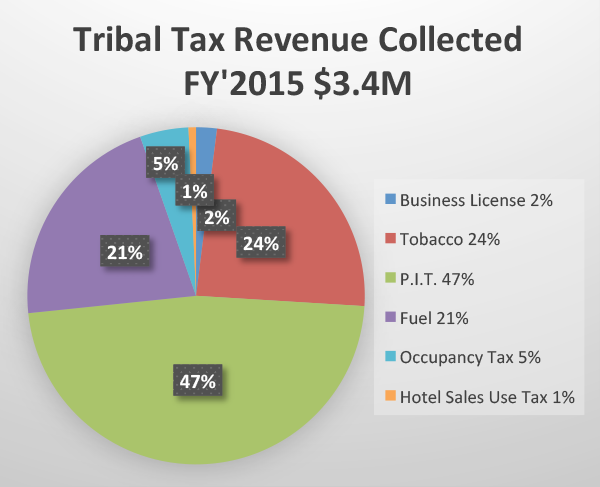

Tribal Need for Governmental Revenue

The Tribes have a duty to provide for the basic needs of Tribal membership, which includes the promotion of health, security, economic, and general welfare of both Tribal members, and non-members, residing or doing business on the Fort Hall Indian Reservation.

he Tribal Tax Code provides a valuable revenue source to support the continued operation of the Tribal government, and facilitates the Tribes’ ability to provide essential governmental services, and provides for the opportunities for development of the Reservation economy. The Tax Code also provides a fair and equitable distribution system for revenues and for Tribal governmental services.

Taxes and Fees Imposed.

Possessory Interest Tax

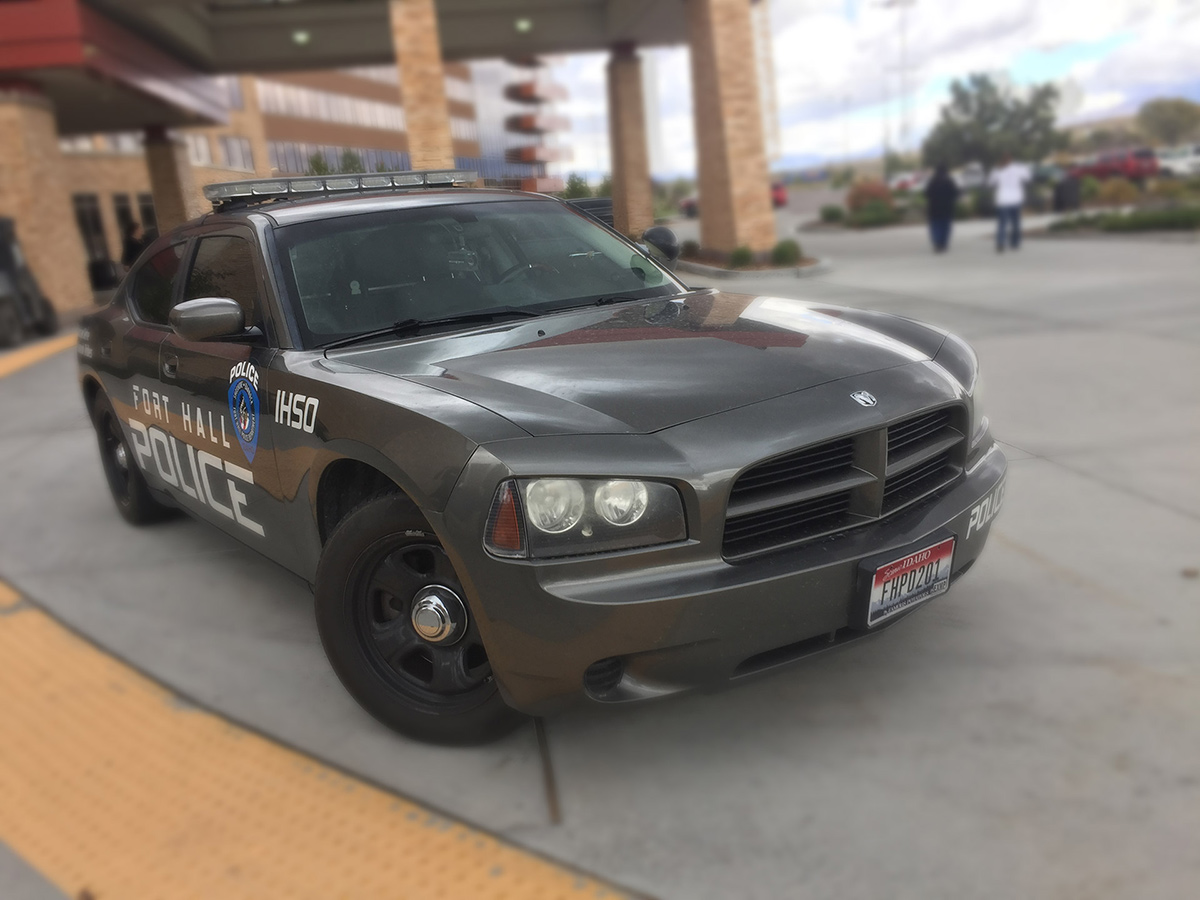

Possessory Interest Tax – The tax is of real and personal property, which includes primary or beneficial interests and any right or interest obtained in a tract of land, within the boundaries of the Reservation by lease, permit, contact, easement, right-of-way, deed, or other agreement, which authorizes a person, to use that real and personal property for business, profit, or use. Supports Fire, Police, Solid Waste, Fish & Game

Tobacco Tax

Imposed at $.015 for each cigarette stick & 10% of other tobacco products. Supports Tribal Health Programs and Police

Fuels Excise Tax

$0.32 per gallon – Supports Transportation & Underground Storage Tank monitoring program

Occupancy Tax

8% & Hotel Sales & Use Tax at 4%

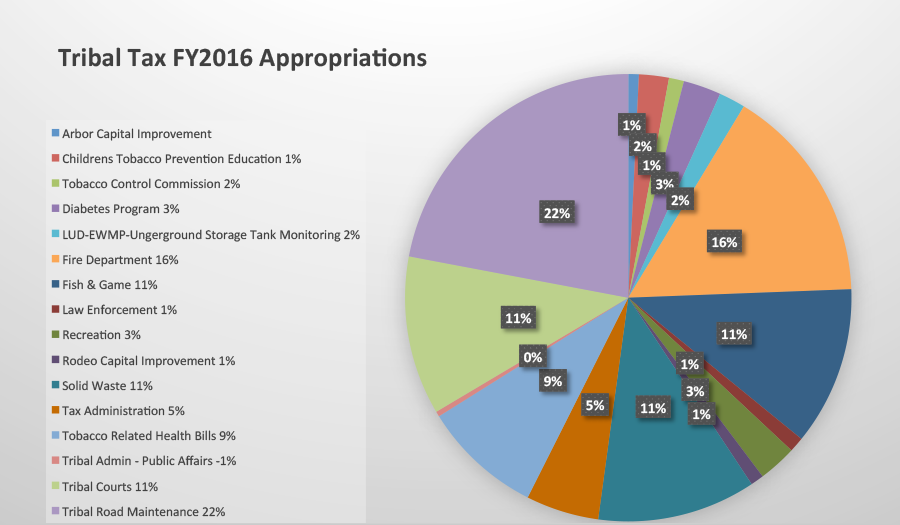

Tribal Programs Supported by

Tax Revenues .

Business License Department.

The Shoshone-Bannock Tribes have jurisdiction to adopt and enforce this Act upon all persons conducting business on the Fort Hall Indian Reservation. Land Use Commission v. A & J’s Market Civ. C-89-63 (1990). Tribal jurisdiction is necessary to protect the culture, social structure, economy, health, safety, welfare, resources and population of the Fort Hall Indian Reservation.

Business License Act

The Business License Act was adopted by the Shoshone-Bannock Tribes in accordance with the provision of the treaty and the Indian Reorganization Act and that such power still exists and is a necessary instrument of self-government and territorial management. Authority for the Business License Act, FHBC-92-S-1, April 15, 1992, if found in the Indian Reorganization Act of June 18, 1934 (48 Stat., 984) as amended and under Article VI, Section 1(a,h,k,l,r,s) and Article VI, Section 2 of the Tribal Constitution.

Term & Fee Schedule

- A Business License shall be good for the calendar year wherein it is granted. All business licenses shall be renewed on or before January 1 of each year and shall expire on December 31 of the same calendar year. The license fee as established in Section 303 shall accompany the application for a business license.

- *If a Business License is issued for less than the entire calendar year the license fee shall be reduced by 1/12th for each full month of such license year that the license was not issued.

- A Business License application form may be obtained during regular business hours at the Business License Department. The license required to be obtained under this Act shall be in addition to all other license, fees, permits, contracts, leases and grants required by Tribal law.

Front row: Wendy Farmer, Nicki Osborne Back Row: Carlee Osborne, Robert Mann and Tahnee Jim

Tax Department Highlights.

Contact Tax Department.

Contact Us

P: (208)478-3789

F: (208)478-3885

14 North Mission Road

P.O. Box 808

Fort Hall, ID 83203

Tax Department Staff.

Front row: Wendy Farmer, Nicki Osborne

Back Row: Carlee Osborne, Robert Mann and Tahnee Jim